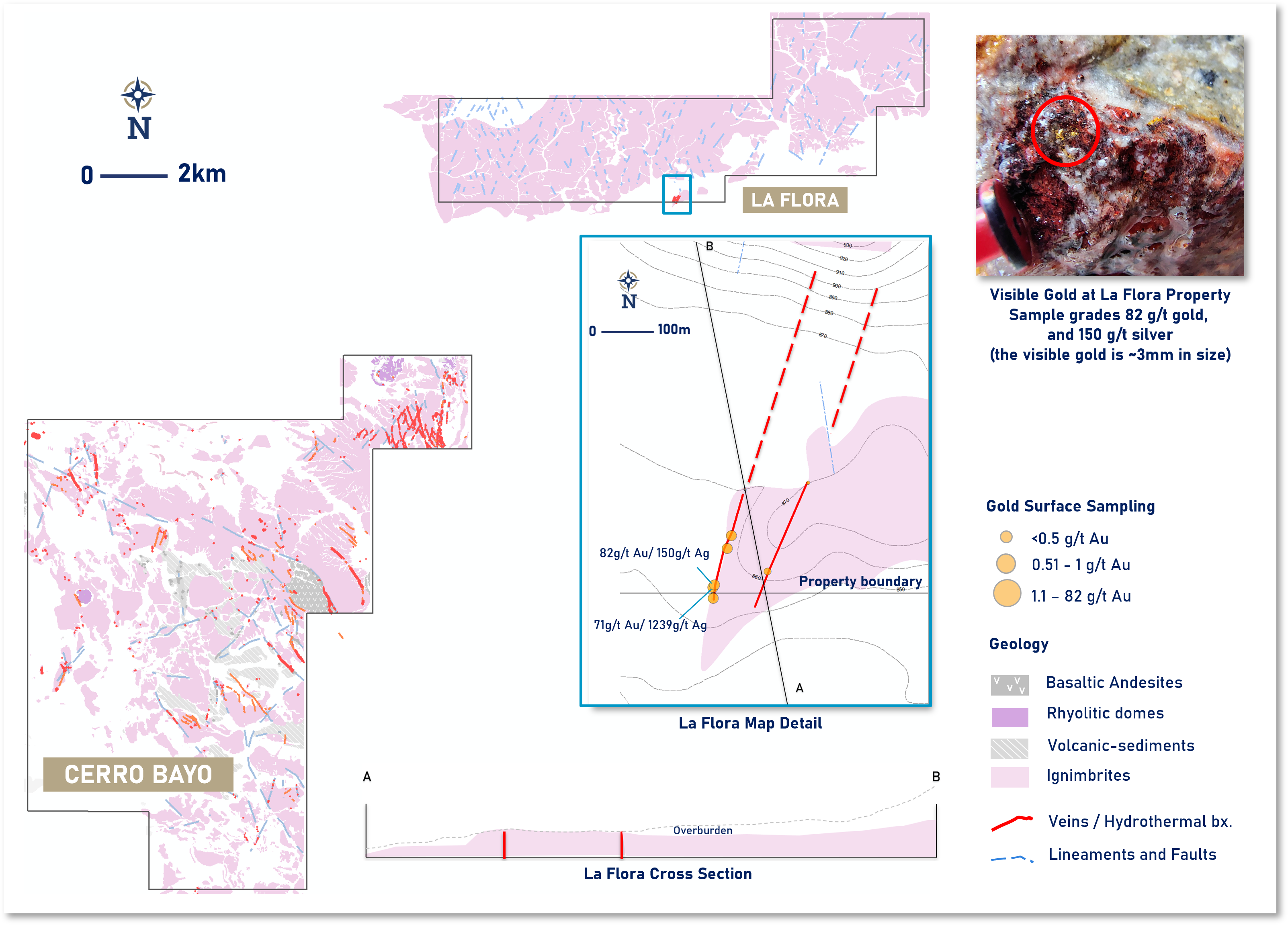

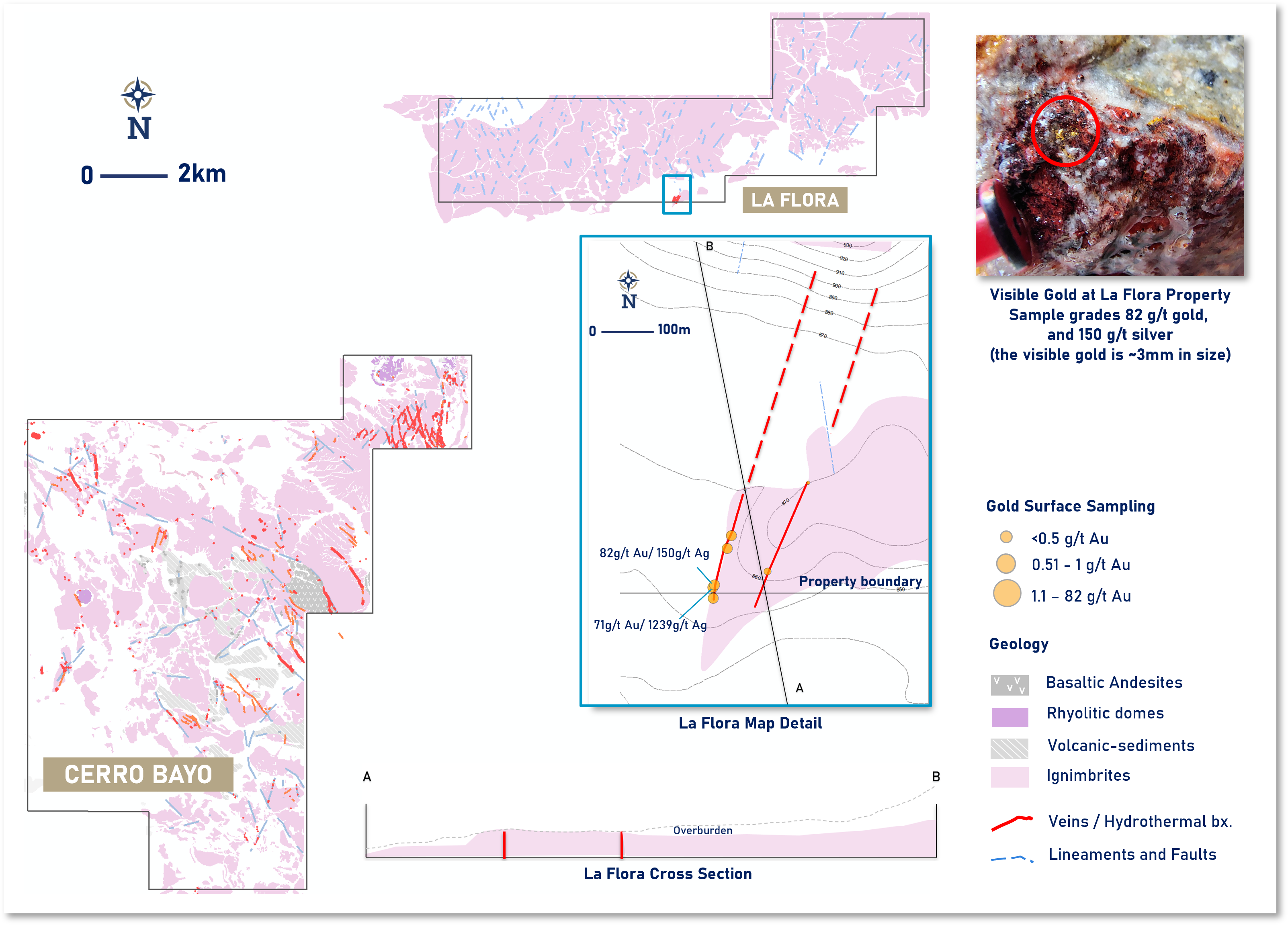

Latin Metals Discovers Visible Gold at La Flora Project, Santa Cruz, Argentina Vancouver, B.C. – Latin Metals Inc. (“Latin Metals” or the “Company”) - (TSXV: LMS) (OTCQB: LMSQF) provides an update on recent exploration results at its Cerro Bayo (“Cerro Bayo”) and La Flora (“La Flora”) projects. Positive Exploration Results at La Flora Samples were collected from two outcropping structures where visible gold was observed as part of a grey, microgranular silica event within the La Flora project area. Assay results from these samples returned values of up to 82 g/t gold and 1,239 g/t silver. To the north, these structures are concealed beneath overburden material and further testing of these bonanza-grade veins will need to be undertaken as part of future drilling.

Figure 1: Map showing in plan view the Cerro Bayo property, including the La Flora area. It provides an enhanced view of the Flora zone, highlighting the recognized veins, collected samples, and the interpreted vein traces beneath the overburden. Cerro Bayo and Regional Significance The Cerro Bayo district is located within the highly prospective Deseado Massif geological province, an area known for its significant precious metal deposits. The region has a long history of mining activity and hosts several producing and past-producing mines, highlighting its exploration potential. The mineralization in the area is typically associated with epithermal systems that have yielded high-grade gold and silver deposits. Latin Metals’ exploration efforts at Cerro Bayo are supported by a wealth of historical data from previous operators, including Barrick Gold, and demonstrate the potential for further discoveries within this established mining jurisdiction. Argentina’s mining sector has seen increasing foreign investment due to its rich mineral endowment and improving regulatory framework. The country is recognized for its world-class gold, silver, and lithium deposits, with the Santa Cruz province, in particular, playing a vital role in Argentina’s gold and silver production. Latin Metals’ Cerro Bayo and La Flora projects align with this broader trend of mineral development and underscore the company’s commitment to unlocking value through systematic exploration and strategic partnerships. Initial exploration in the Cerro Bayo project was completed by Barrick Gold. In late 2024, the Latin Metals team completed additional mapping at Cerro Bayo and expanded exploration to La Flora for the first time, using Barrick’s historical data as a foundation to standardize lithological interpretations in the La Flora area. Updated Presentation The Company’s technical presentation for Cerro Bayo has been significantly updated to include geological mapping, sampling, and photographs of outcropping altered and mineralized rocks results at drill target scale. Identification of visible gold during our first exploration at the La Flora project reflects the district-scale perspective of the Cerro Bayo district. The updated presentation materials can be downloaded here. Next Steps The Company has completed all work and met all requirements for granting of an exploration and drilling permit. We are hopeful that the permit will be approved by government authorities in Q1 2025. Latin Metals to Attend PDAC 2025 – Booth #2329 Latin Metals will attend PDAC 2025 in Toronto from March 2-5, 2025, engaging with investors and industry leaders to discuss its prospect generator model and exploration projects in Argentina & Peru. Visit us at Booth #2329 or schedule a meeting at info@latin-metals.com About Latin Metals Latin Metals is a mineral exploration company acquiring a diversified portfolio of assets in South America. The Company operates with a Prospect Generator model focusing on the acquisition of prospective exploration properties at minimum cost, completing initial evaluation through cost-effective exploration to establish drill targets, and ultimately securing joint venture partners to fund drilling and advanced exploration. Shareholders gain exposure to the upside of a significant discovery without the dilution associated with funding the highest-risk drill-based exploration. Stay up-to-date on Latin Metals developments by joining our online communities on X, Facebook, LinkedIn and Instagram. QA/QC The work program at Cerro Bayo was designed and supervised by Eduardo Leon, the Company's Exploration Manager, who is responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project rigorously prepare and track samples which are security sealed and shipped to the Alex Stewart laboratory in Perito Moreno. Samples used for the results described herein are prepared and analyzed for Gold and Silver. Qualified Person Keith J. Henderson, P.Geo., is the Company's qualified person as defined by NI 43-101 and has reviewed the scientific and technical information that forms the basis for portions of this news release. He has approved the disclosure herein. Mr. Henderson is not independent of the Company, as he is an employee of the Company and holds securities of the Company. On Behalf of the Board of Directors of LATIN METALS INC. “Keith Henderson” President & CEO For further details on the Company readers are referred to the Company's web site (www.latin-metals.com) and its Canadian regulatory filings on SEDAR+ at www.sedarplus.com. For further information, please contact: Keith Henderson Suite 890 - 999 West Hastings Street,

Vancouver, BC, V6C 2W2 Phone: 604-638-3456

E-mail: info@latin-metals.com Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. Cautionary Note Regarding Forward-Looking Statements This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, the anticipated content, commencement, timing and cost of exploration programs in respect of the Property and otherwise, anticipated exploration program results from exploration activities, and the Company's expectation that it will be able to enter into agreements to acquire interests in additional mineral properties, the discovery and delineation of mineral deposits/resources/reserves on the Properties, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, market fundamentals will result in sustained precious and base metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of the Company’s Argentine projects in a timely manner, the availability of financing on suitable terms for the development, construction and continued operation of the Company projects, and the Company’s ability to comply with environmental, health and safety laws. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include, among others, operating and technical difficulties in connection with mineral exploration and development and mine development activities at the Properties, including the geological mapping, prospecting and sampling programs being proposed for the Properties (the "Programs"), actual results of exploration activities, including the Programs, estimation or realization of mineral reserves and mineral resources, the timing and amount of estimated future production, costs of production, capital expenditures, the costs and timing of the development of new deposits, the availability of a sufficient supply of water and other materials, requirements for additional capital, future prices of precious metals and copper, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, possible variations in ore grade or recovery rates, possible failures of plants, equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, delays or the inability of the Company to obtain any necessary permits, consents or authorizations required, any current or future property acquisitions, financing or other planned activities, changes in laws, regulations and policies affecting mining operations, hedging practices, currency fluctuations, title disputes or claims limitations on insurance coverage and the timing and possible outcome of pending litigation, environmental issues and liabilities, risks related to joint venture operations, and risks related to the integration of acquisitions, as well as those factors discussed under the heading as well as those factors discussed under the heading “Risk Factors” in the Company’s annual management’s discussion and analysis and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company’s profile on the SEDAR+ website at www.sedarplus.ca. Readers are cautioned not to place undue reliance on forward looking statements. Except as otherwise required by law, the Company undertakes no obligation to update any of the forward-looking information in this news release or incorporated by reference herein. View in PDF Format |