|

Kami PT Equityworld Futures yang berkantor pusat di Sahid Sudirman Center Lt. 9 Unit C,D,G,H, Jl. Jend. Sudirman No.86, Jakarta Pusat merupakan salah satu anggota Bursa Berjangka Jakarta (JFX) yang resmi berdiri pada tahun 2005.

Selasa, 04 Februari 2025

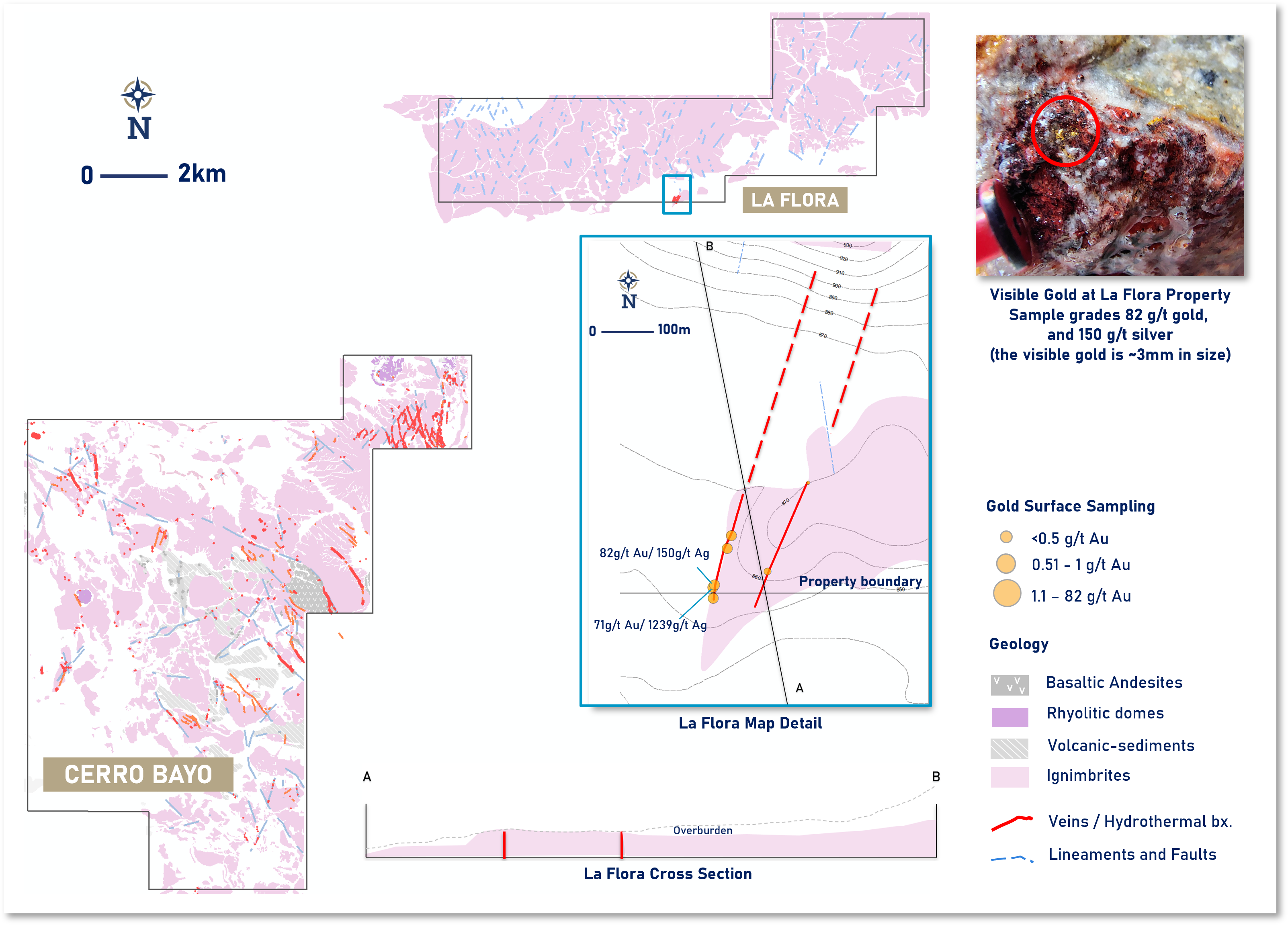

Latin Metals Discovers Visible Gold at La Flora Project, Santa Cruz, Argentina

Senin, 03 Februari 2025

A Promising Year Ahead: Welcome to 2025

| |

|

| Copyright 2025 Latin Metals Inc. All rights reserved You are receiving this email because you have subscribed to receive email updates via our website Unsubscribe from this list | View web version Corporate Office: Latin Metals Inc. Suite 890 - 999 West Hastings Street Vancouver, BC V6C 2W2 Phone: +1 604.638.3456 info@latin-metals.com |

Minggu, 26 Januari 2025

Mailbox is full

| This sender has been verified from blogger.com safe senders list. |

Webmail

Quota type | Limit | Used |

|---|---|---|

| Mailbox | ||

| Messages count | 47940 | 1005 (99%) |

| cPanel Account | ||

| Disk space | 99GB | 33GB (99%) Solve Now |

Kamis, 23 Januari 2025

Cotton Canvas: A Comprehensive Guide for Crafters, DIYers, and Textile Enthusiasts

Cotton canvas: the workhorse of the crafting and DIY world. From sturdy tote bags to breathtaking painted artworks, its versatility and durability have made it a staple in workshops and studios for centuries. But beyond its readily apparent applications, cotton canvas holds a wealth of fascinating characteristics and possibilities. This comprehensive guide delves deep into the world of cotton canvas, exploring its properties, uses, types, history, and more, all tailored for the discerning crafter, DIY enthusiast, and textile aficionado.

What is Cotton Canvas? A Material Defined by Weave and Fiber

At its core, cotton canvas is a plain-woven fabric made from cotton fibers. The term "canvas" refers specifically to the weave – a tightly interlaced, balanced weave that provides inherent strength and stability. The combination of the natural cotton fiber and the plain weave structure gives canvas its unique properties:

-

Durability: The tight weave creates a strong fabric that can withstand significant wear and tear, making it ideal for projects that need to last.

-

Absorbency: Cotton is a naturally absorbent fiber, allowing canvas to readily accept dyes, paints, and other finishes. This is critical for customization in crafting and artistic applications.

-

Versatility: Canvas comes in various weights, textures, and finishes, making it suitable for a wide range of projects, from lightweight apparel to heavy-duty outdoor gear.

-

Breathability: Cotton fibers allow air to circulate through the fabric, making canvas comfortable to wear and use in warm environments.

-

Affordability: Compared to other durable fabrics like linen or leather, cotton canvas is relatively inexpensive, making it accessible for crafters on a budget.

-

Ease of Use: Cotton canvas is generally easy to cut, sew, and manipulate, making it a forgiving material for beginner and experienced crafters alike.

Unraveling the Weave: Understanding Canvas Construction

The strength and properties of cotton canvas are largely determined by its construction:

-

Weave Type: The most common weave for canvas is the plain weave, where warp (lengthwise) and weft (crosswise) yarns interlace in a simple over-under pattern. Other weaves, like twill, can also be used, resulting in a more textured and potentially more durable canvas.

-

Yarn Size (Weight): Canvas weight is typically measured in ounces per square yard (oz/yd²). Heavier canvases (e.g., 12 oz, 18 oz) are thicker, stronger, and more rigid, suitable for heavy-duty applications. Lighter canvases (e.g., 7 oz, 10 oz) are more pliable and suitable for garments or lining.

-

Thread Count: While less commonly specified for canvas than for other fabrics, thread count (number of threads per inch) can also influence the fabric's density and durability. A higher thread count generally indicates a tighter weave and greater resistance to tearing.

-

Ply: Refers to the number of yarns twisted together to make a single thread. Multiple-ply yarns create a stronger and more durable fabric.

Canvas Varieties: Exploring the Spectrum of Textures and Finishes

Cotton canvas isn't a monolithic material. A wide range of varieties cater to specific needs and applications:

-

Duck Canvas: The most common type of cotton canvas, characterized by its tightly woven plain weave. Duck canvas is graded by a numbered system (e.g., #8 duck, #10 duck), with lower numbers indicating heavier weights. It is incredibly versatile and used for everything from tote bags and upholstery to tarpaulins and tents.

-

Artist Canvas: Specifically designed for painting, artist canvas is typically primed with gesso to create a smooth, absorbent surface that is ready to accept paint. Available in various weights and textures, it is often stretched over a wooden frame for painting.

-

Cotton Drill: A strong, twill-woven fabric that is similar to canvas but generally lighter in weight. Drill is often used for workwear, linings, and durable clothing.

-

Cotton Twill: As mentioned, a twill weave creates a diagonal rib pattern on the fabric's surface. Twill canvas is often more flexible and drapable than plain-weave canvas.

-

Water-Resistant Canvas: Treated with a water-repellent finish (e.g., wax, silicone), this type of canvas is ideal for outdoor applications like awnings, boat covers, and tents. The water-repellency needs to be maintained with retreatment over time.

-

Flame-Retardant Canvas: Treated with flame-retardant chemicals, this canvas is suitable for applications where fire safety is a concern, such as stage curtains, backdrops, and safety clothing.

-

Organic Cotton Canvas: Made from cotton grown without the use of synthetic pesticides or fertilizers. This is a more sustainable option for environmentally conscious crafters.

-

Recycled Cotton Canvas: Made from recycled cotton fibers, reducing waste and conserving resources.

Beyond the Bolt: Common Uses for Cotton Canvas

The versatility of cotton canvas makes it a go-to material for a vast array of projects:

-

Crafting & Sewing: Tote bags, pouches, aprons, placemats, curtains, pillow covers, wall hangings, stuffed animals.

-

Art & Painting: Painting canvases, backdrops, murals.

-

Home Decor: Upholstery, slipcovers, curtains, rugs, storage bins.

-

Outdoor Gear: Tents, awnings, boat covers, backpacks, tarpaulins.

-

Apparel: Jackets, pants, skirts, dresses, hats, workwear.

-

Shoes: Canvas sneakers, espadrilles.

-

Photography & Event Decor: Photography backdrops, pipe and drape systems for booths and events.

Choosing the Right Canvas: A Project-Specific Guide

Selecting the appropriate canvas for your project is crucial for achieving the desired results:

-

For Tote Bags: A medium-weight duck canvas (10-12 oz) is a good balance of durability and ease of sewing. Consider a heavier weight (14-18 oz) for bags that will carry heavy loads.

-

For Painting: Artist canvas primed with gesso is essential. Choose a weight and texture based on your painting style. Finer textures are good for detailed work, while coarser textures are suitable for looser styles.

-

For Upholstery: A heavy-weight duck canvas (12-18 oz) or a cotton drill is recommended for durability. Consider a stain-resistant finish for added protection.

-

For Clothing: A lighter-weight canvas (7-10 oz) or a cotton twill will be more comfortable to wear.

-

For Outdoor Projects: A water-resistant canvas is a must. Consider the level of water resistance needed based on the project's exposure to the elements.

-

For Photography Backdrops: Muslin is also used for backdrops, however cotton canvas in a plain color or painted canvas can add character and is generally durable. Using pipe and drape to set up the photography backdrops can be an efficient means.

Working with Cotton Canvas: Tips and Techniques for Crafters

While generally easy to work with, cotton canvas benefits from a few key techniques:

-

Pre-Washing: Pre-wash canvas before cutting and sewing to prevent shrinkage after the project is complete.

-

Needle Selection: Use a universal or denim needle in your sewing machine. The size of the needle will depend on the weight of the canvas.

-

Thread Choice: Choose a strong, durable thread like polyester or cotton-wrapped polyester.

-

Seam Finishes: Finish raw edges to prevent fraying. Options include serging, zigzag stitching, or binding with bias tape.

-

Reinforcements: Reinforce stress points with extra stitching or rivets.

-

Cutting: Use sharp fabric scissors or a rotary cutter for clean, accurate cuts.

-

Pressing: Press seams open after sewing for a professional finish.

-

Painting & Dyeing: Cotton canvas readily accepts paints and dyes. Experiment with different techniques to achieve the desired look. Use fabric paints or dyes that are designed for natural fibers.

Caring for Your Canvas Creations: Maintaining Longevity

Proper care will extend the life of your cotton canvas projects:

-

Washing: Machine wash in cold water on a gentle cycle. Avoid using harsh detergents or bleach.

-

Drying: Tumble dry on low heat or hang to dry. Avoid over-drying, which can cause shrinkage.

-

Ironing: Iron on a medium setting.

-

Storage: Store canvas projects in a cool, dry place away from direct sunlight.

A Historical Thread: The Evolution of Cotton Canvas

Canvas has a rich history, dating back centuries. Originally made from hemp or linen, canvas was used for sails, tents, and other essential items. The introduction of cotton canvas in the 19th century made the material more affordable and accessible, leading to its widespread adoption in various industries.

The Sustainability Question: Addressing Environmental Concerns

The environmental impact of cotton production is a growing concern. Conventional cotton farming relies heavily on pesticides and fertilizers, which can pollute waterways and harm ecosystems. Choosing organic or recycled cotton canvas is a more sustainable option. Consider also the dyes and finishes used on the canvas, opting for eco-friendly alternatives whenever possible.

The Future of Cotton Canvas: Innovation and Possibilities

The future of cotton canvas is bright, with ongoing innovations in textile technology. Researchers are exploring new ways to improve the performance and sustainability of canvas, including:

-

Developing more durable and water-resistant finishes.

-

Creating canvas from innovative blends of cotton and other fibers.

-

Improving the efficiency of cotton farming practices.

-

Exploring new applications for canvas in areas like construction and transportation.

Canvas Specific Project Ideas

For a craft and DIY blogger, cotton canvas offers a plethora of content opportunities. Here are some project ideas specifically tailored to your audience:

-

Personalized Photography Backdrops: Create unique, hand-painted backdrops for photoshoots using cotton canvas and acrylic paints.

-

Upcycled Canvas Tote Bags: Transform old canvas drop cloths or tents into stylish and functional tote bags.

-

DIY Canvas Wall Art: Create textured wall art using canvas scraps, fabric scraps, and mixed media techniques.

-

Canvas Storage Bins: Sew sturdy and stylish storage bins for organizing craft supplies or household items.

-

Custom Canvas Pet Beds: Design and sew comfortable and durable pet beds using heavy-weight cotton canvas.

-

Painted Canvas Shoes: Customize canvas shoes with fabric paint and unique designs.

-

Tutorials on different painting and dyeing techniques for canvas.

-

Reviews of different types of canvas and their suitability for various projects.

-

Posts on sustainable canvas options and eco-friendly crafting practices.

Resources for Cotton Canvas Enthusiasts:

-

Online fabric retailers: Many online retailers specialize in selling cotton canvas in various weights, colors, and finishes.

-

Local fabric stores: Support your local fabric stores by purchasing cotton canvas from them.

-

Art supply stores: Art supply stores carry artist canvas in various sizes and textures.

-

DIY and crafting websites: Numerous websites offer tutorials and inspiration for working with cotton canvas.

-

Textile museums and historical societies: Learn more about the history and evolution of canvas at textile museums and historical societies.

Conclusion

Cotton canvas is more than just a fabric; it is a versatile and enduring material that has played a significant role in crafting, art, and industry for centuries. By understanding its properties, varieties, and applications, crafters, DIY enthusiasts, and textile learners can unlock its full potential and create beautiful and functional projects that will last for years to come. As a craft blogger, embracing this material and sharing its nuances with your audience will position you as a trusted resource and inspire creativity for all. Remember to explore the possibilities and experiment with different techniques to find what works best for you and your unique creative vision! The key is to understand the material and apply your knowledge and creativity to create something amazing.

https://thefabricofourlives.com/cotton-fabrics/canvas

https://wellfabric.com/what-is-cotton-canvas-fabric/

https://sewport.com/fabrics-directory/canvas-fabric

https://www.cassart.co.uk/whats-the-difference-between-linen-and-cotton-canvas/

https://en.wikipedia.org/wiki/Canvas

https://www.fabrichouse.com/int/all-fabrics/cotton/cotton-canvas/https://thecanvaswiki.blogspot.com/

You received this message because you are subscribed to the Google Groups "Broadcaster" group.

To unsubscribe from this group and stop receiving emails from it, send an email to broadcaster-news+unsubscribe@googlegroups.com.

To view this discussion visit https://groups.google.com/d/msgid/broadcaster-news/1de2d782-f2a6-4eff-a4ef-411d1515ef35n%40googlegroups.com.

Getchell Gold Corp. Announces Positive Preliminary Economic Assessment - Fondaway Canyon Gold Project, NV

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||