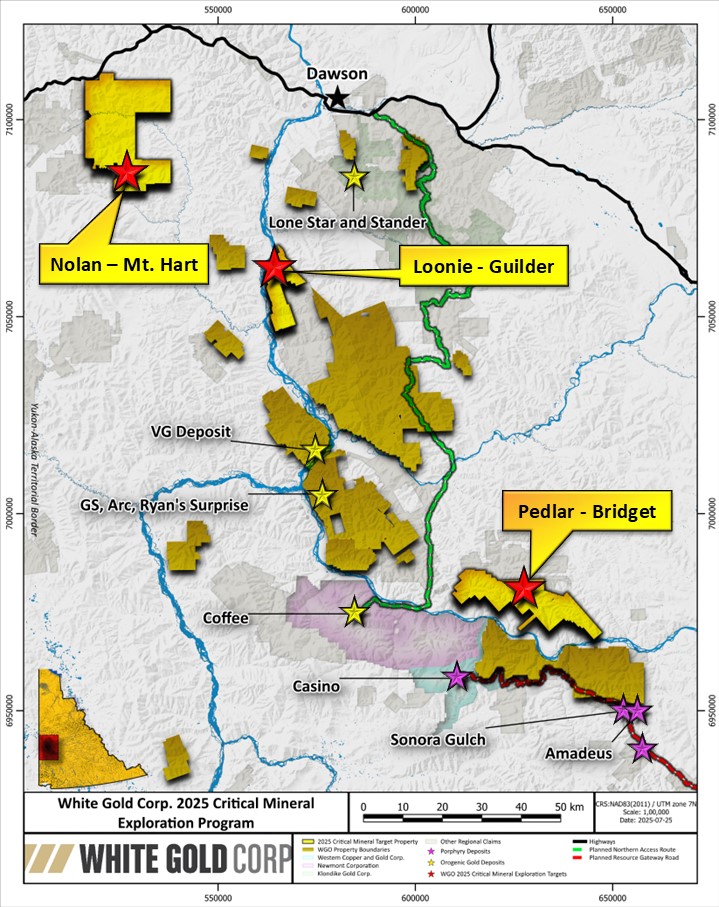

White Gold Corp. Launches Phase I of 2025 Exploration Program Commencing IP Geophysics Surveys on Multiple Highly Prospective Critical Mineral Targets | | TORONTO, July 28, 2025 – White Gold Corp. (TSX.V: WGO, OTCQX: WHGOF, FRA: 29W) (the "Company") is pleased to announce it has commenced its Critical Metals Exploration Program on key properties across its district-scale land package in Yukon, Canada. Phase I of the 2025 exploration program is a continuation of the Company’s successful expanded exploration focus beyond gold, targeting critical metals including copper (Cu), molybdenum (Mo), tungsten (W), antimony (Sb) and bismuth (Bi) amongst others. Phase II of the Company’s strategic 2025 Exploration Program will focus on high priority gold projects amongst the Company’s existing significant gold resources and recent new discoveries of gold occurrences on its district scale land package. Details on White Gold Corp Phase II 2025 Exploration program outlining its upcoming drill program focused on high priority gold targets and other activities will be released in due course. | | | White Gold Corp’s property portfolio (Figure 1) includes 15,362 quartz claims across 21 properties covering 300,000 hectares (3,000 km2), representing approximately 40% of the White Gold District and hosts numerous prospective gold and critical mineral targets in addition to the Company’s flagship White Gold Project which comprises 1,203,000 ounces of gold in the Indicated Resource category (17.7 million tonnes averaging 2.12 g/t Au) and 1,116,600 ounces of gold in the Inferred Resource category (24.5 million tonnes averaging 1.42 g/t Au)(1) and remains open for further expansion. Additional increases to the size of the resource may also be possible through an ongoing analysis to incorporate mineralization hosted within the Company’s Target for Further Exploration area that hosts an additional estimated 10 – 12 million tonnes grading between 1 – 2 g/t Au.

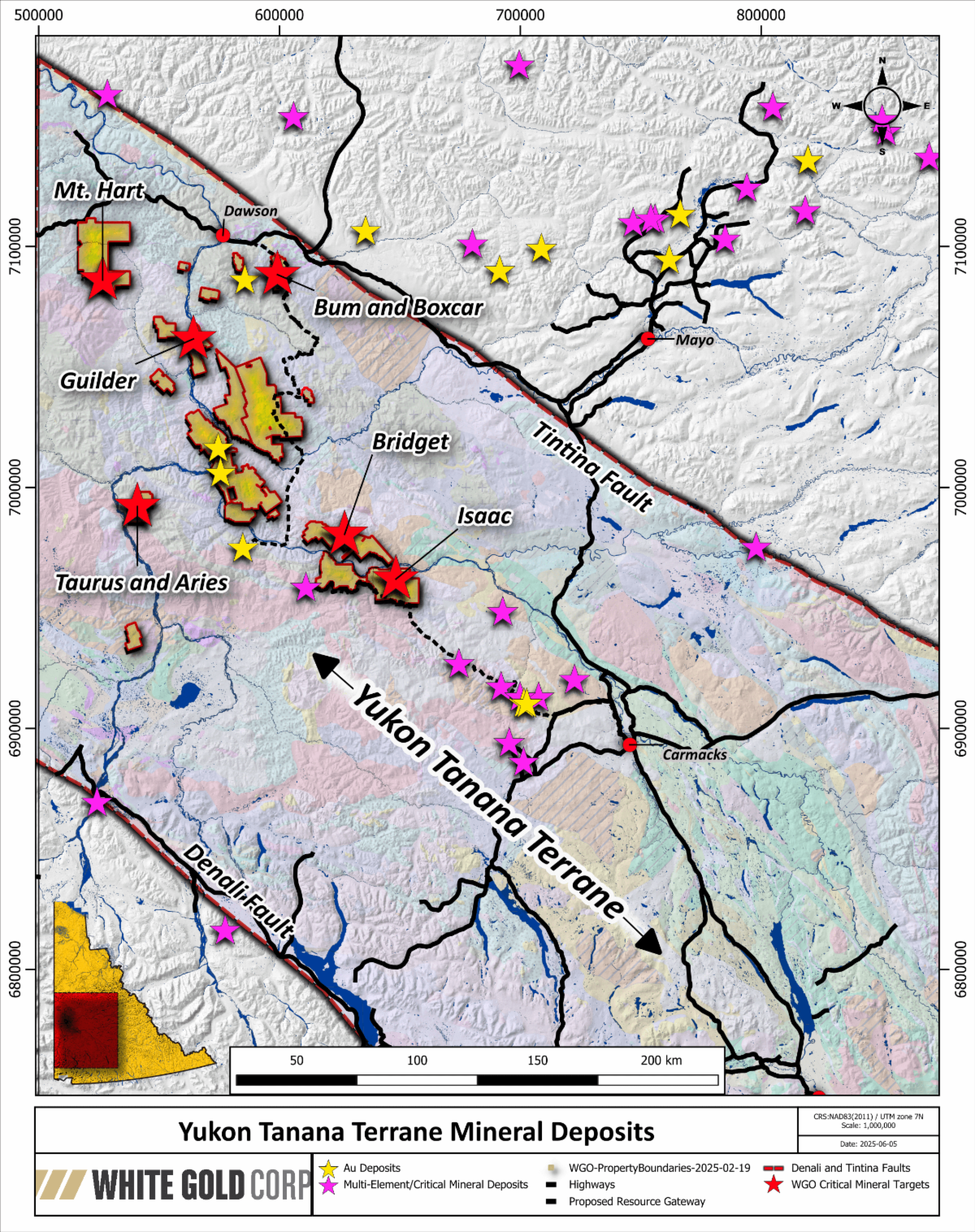

A video overview by management of Phase I Exploration program can be found here: https://www.youtube.com/watch?v=lge8B_SWLLM | | “Our entry into the critical metals space highlights the untapped multi-commodity potential of our vast Yukon portfolio,” stated Dylan Langille, Vice President of Exploration for White Gold Corp. “Preliminary work has identified compelling targets with favourable geophysical and geochemical signatures for critical metals, and we are excited to advance these prospects with IP surveys to delineate drill targets.” | | “The Yukon remains one of Canada’s most prospective and underexplored mining districts,” stated David D’Onofrio, Chief Executive Officer. “By expanding our exploration efforts to include critical metals, White Gold Corp. is well-positioned to capitalize on growing demand for these commodities, while continuing to build on our proven track record for gold discoveries which have already led to the delineation of one of the highest-grade multi-million ounce undeveloped open-pittable gold deposits in Canada. We look forward to continuing to unlock the gold and critical mineral endowment of our prospective district scale land package in a tier 1 jurisdiction which has such a prolific mining history and untapped prospectivity.” | | | The geology underlying the Company’s land package (Figure 2) is prospective for several critical minerals, including copper, molybdenum, tungsten, antimony and bismuth amongst others. Middle to Late Cretaceous aged intrusions are favourable for porphyry deposits containing primary sources of copper, molybdenum ± tungsten. The best example in the region is Western Copper and Gold Corporation’s (TSX: WRN, NYSE American: WRN) Casino copper-gold-molybdenum porphyry deposit.

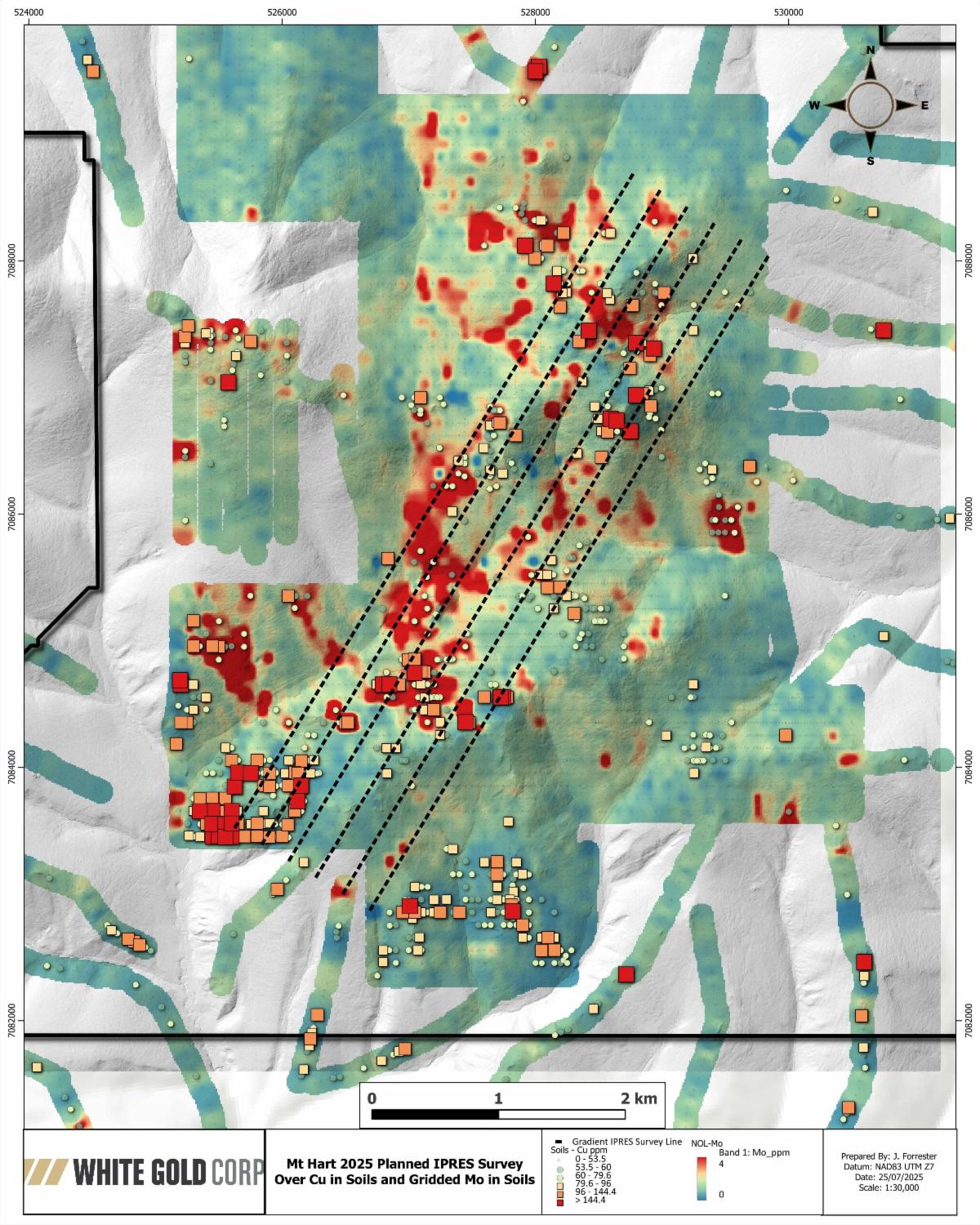

Initial activities have commenced on three of the Company’s highly prospective critical mineral targets - the Bridget target on the Pedlar Property, the Guilder target of the Loonie Property, and the Mt. Hart target on the Nolan Property. The program will include both gradient and dipole-dipole induced polarization (IP) surveys designed to refine high-priority porphyry style targets for drill testing.

Highlights:

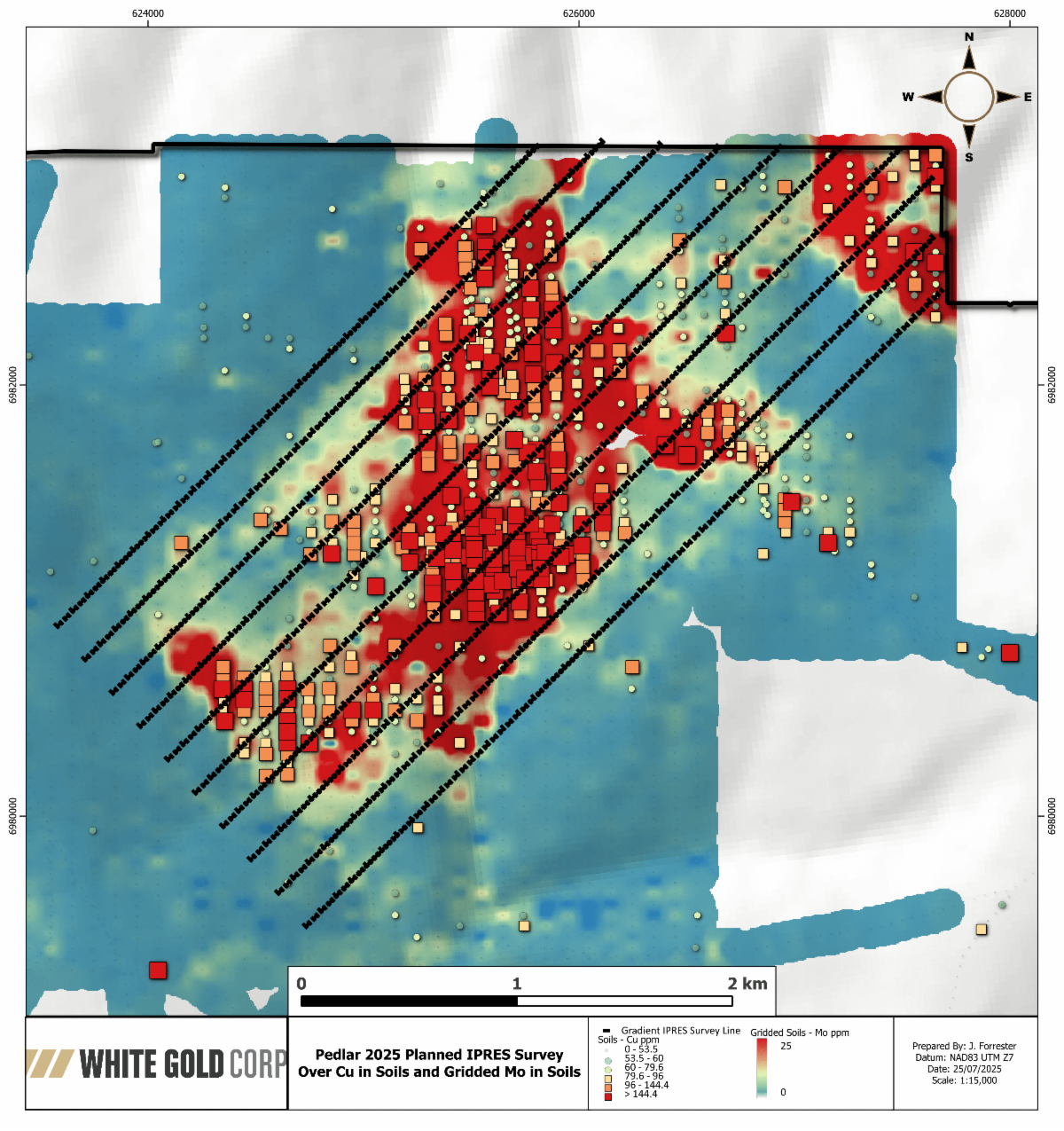

Pedlar Property (Figure 3) | | - Measuring 3 km NW-SE by 3.5 km NE-SW, the Bridget target represents a large, early-stage, geochemically zoned copper-molybdenum-tungsten target that has never been diamond drill tested.

- The soil geochemistry footprint is notably characterized by Mo-in-soil values commonly over 250 ppm with majority (over 400 samples) above 20ppm. Cu-in-soil values are typically over 100ppm, and W-in-soil values frequently above 30ppm (as high as 100ppm).

- Two large northwest-southeast oriented fault systems cut the target in the north and in the south.

- A 40 line-kilometers Induced Polarization (IP) Gradient survey, and a Dipole-Dipole survey will be conducted over the target to identify subsurface chargeability and resistivity anomalies indicative of critical metal mineralization.

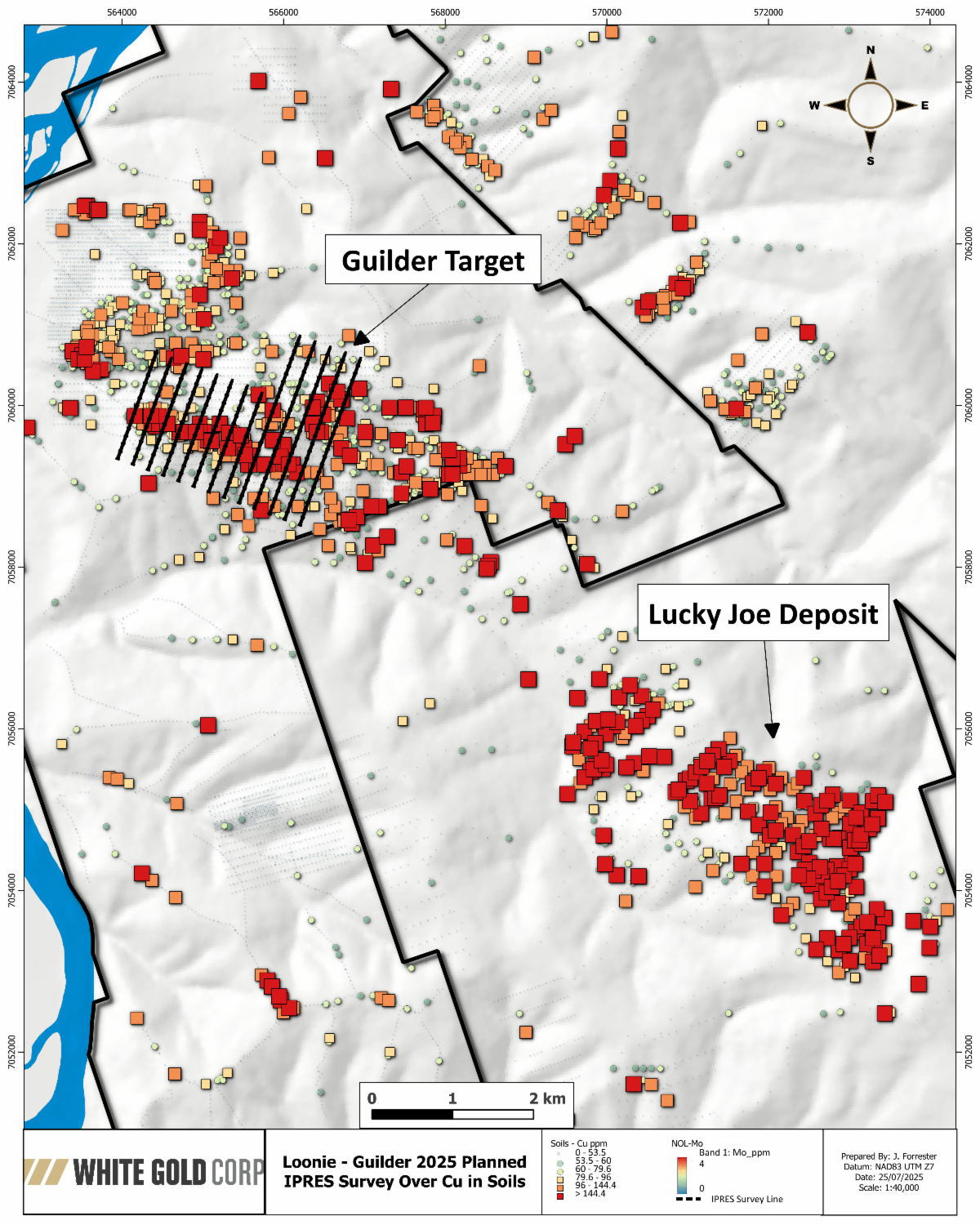

Loonie Property (Figure 4) | | - The Guilder target has identified an additional 3.0 by 0.5km northwest-trending zone of anomalous Cu-in-soil results that is within a few kilometres and trending towards another prospective target in the area.

- 22 line-kilometer Gradient Induced Polarization (IP) surveys, and a Dipole-Dipole survey on the Guilder target as follow up to the high copper signature identified in soil sampling, and major structural trend identified in the interpretation of a 2024 VLF-EM and Lidar surveys.

Nolan Property (Figure 5) | | - The Mt. Hart target is a large zoned multi-element soil geochemical anomaly hosting an enrichment in Au, Ag, Cu, Mo, W, Pb, Bi, Sb, and Te. Previous mapping has concluded potential that a porphyry core is likely to exist at depth and that alteration seen at surface may represent epithermal style alteration.

- 34 line-kilometer Gradient Induced Polarization (IP) surveys, and a Dipole-Dipole survey on the Mt. Hart target as follow up to a high molybdenum (Mo) anomaly identified in previous soil grids.

Maps outlining the Company’s phase I 2025 exploration programs and target-specific maps are accompanying this news release and can be found at http://whitegoldcorp.ca/investors/exploration-highlights/. | | | Regional Exploration

Regional exploration work including geological mapping and prosecting, soil sampling, and LiDAR will also be carried out on several properties with a goal of identifying new targets for future advancement.

Regional Setting – The Dawson Range The Dawson Range forms an east-southeast trending mountain range which hosts several important mineral deposits and prospects including the Casino porphyry Copper-Gold deposit, the Minto Mine and the Carmacks Copper project (Granite Creek Copper Ltd., TSXV: GCX, OTCQB: GCXXF). Both are interpreted to represent metamorphosed copper-gold-silver porphyry deposits. Porphyry deposits in the Dawson Range can be divided into 2 major ages, Late Triassic (Minto, Carmacks) and Late Cretaceous (Casino, Cash, Revenue). In addition to porphyry mineralization, epithermal, skarn, and polymetallic to gold-dominant mineralized veins, breccias and fracture zones also occur throughout the Dawson Range. In recent years this area has drawn increased attention and investment from both junior and major mining companies due to its high mineral potential. | | | About White Gold Corp. The Company owns a portfolio of 15,362 quartz claims across 21 properties covering approximately 300,000 hectares (3,000 km2) representing approximately 40% of the Yukon’s emerging White Gold District. The Company’s flagship White Gold project hosts four near-surface gold deposits which collectively contain an estimated comprises 1,203,000 ounces of gold in the Indicated Resource category (17.7 million tonnes averaging 2.12 g/t Au) and 1,116,600 ounces of gold in the Inferred Resource category (24.5 million tonnes averaging 1.42 g/t Au) (1). Regional exploration work has also produced several other new discoveries and prospective targets on the Company’s claim packages which border sizable gold discoveries including the Coffee project owned by Newmont Corporation, and Western Copper and Gold Corporation’s Casino project. For more information visit www.whitegoldcorp.ca. (1) See White Gold Corp. technical report titled “2024 Technical Report for the White Gold Project, Dawson Range, Yukon, Canada”, Effective Date October 28, 2024, Report Date January 3, 2025, NI 43-101 Compliant Technical Report prepared by Dr. Gilles Arseneau, P.Geo., available on SEDAR+. (2) All numbers are rounded. Overall numbers may not be exact due to rounding Qualified Person Steven Walsh, P.Geo. and Senior Geologist for the Company is a “qualified person” as defined under National Instrument 43-101 – Standards of Disclosure of Mineral Projects and has reviewed and approved the content of this news release. Cautionary Note Regarding Forward Looking Information This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", “proposed”, "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, the Company’s objectives, goals and exploration activities conducted and proposed to be conducted at the Company’s properties; future growth potential of the Company, including whether any proposed exploration programs at any of the Company’s properties will be successful; exploration results; and future exploration plans and costs and financing availability. These forward-looking statements are based on reasonable assumptions and estimates of management of the Company at the time such statements were made. Actual future results may differ materially as forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to materially differ from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors, among other things, include: the expected benefits to the Company relating to the exploration conducted and proposed to be conducted at the White Gold properties;; failure to identify any additional mineral resources or significant mineralization; the preliminary nature of metallurgical test results; uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on the Company’s properties; business integration risks; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; fluctuations in currency markets (such as the Canadian dollar to United States dollar exchange rate); change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining and mineral exploration; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); the unlikelihood that properties that are explored are ultimately developed into producing mines; geological factors; actual results of current and future exploration; changes in project parameters as plans continue to be evaluated; soil sampling results being preliminary in nature and are not conclusive evidence of the likelihood of a mineral deposit; title to properties; ongoing uncertainties relating to the COVID-19 pandemic; and those factors described under the heading "Risks Factors" in the Company's annual information form dated July 29, 2020 available on SEDAR+. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements and information. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward-looking information, will prove to be accurate. The Company does not undertake to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law. Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release. For Further Information, Please Contact: Contact Information: David D’Onofrio Chief Executive Officer White Gold Corp. (647) 930-1880 ir@whitegoldcorp.ca | | | | |