Vancouver, B.C. – Latin Metals Inc. ("Latin Metals" or the "Company") - (TSXV: LMS) OTCQB: LMSQF) is pleased to announce the results of the Induced Polarization ("IP") survey at its 100% own Lacsha project, located in the Coastal Copper Belt, Peru. The objective of the recently completed survey was to determine the distribution of potentially copper bearing sulphides (IP chargeability), distribution of alteration (IP resistivity and ground magnetics) to frame the Lacsha copper target in the context of an upright, intact porphyry copper system and identify drill targets. The responses in general correlate well with generally accepted porphyry exploration models and the result is four high-priority targets areas (Figures 1 and 2).

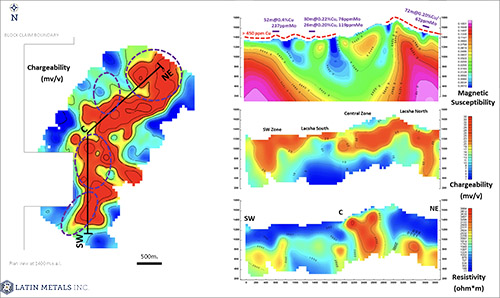

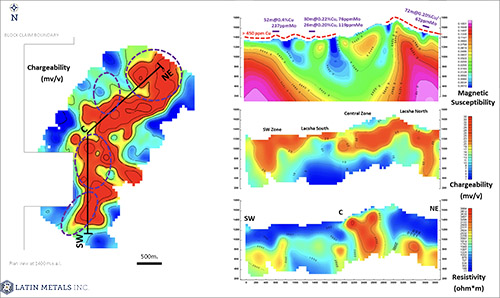

Figure 1. Geophysical responses at Lacsha including IP Chargeability, Resistivity, and Magnetic responses defining four priority target areas, which are highlighted as circular dashed lines.

"The recently received IP data is the final layer of data that we will use to define drill targets. Combined with magnetic data and surface geochemistry, we see a relatively simple suite of anomalies that define four significant drill targets," stated Keith Henderson, Latin Metals' President & CEO. "Surface chip channel sampling completed in Q1 defined consistent mineralization including 52m grading 0.38% copper and 237ppm molybdenum. While these grades are excellent, the IP chargeability data points to peak chargeability below surface at approximately 100m from surface. The project will need to be drilled to establish whether chargeability is related to copper mineralization."

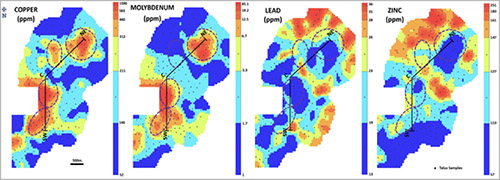

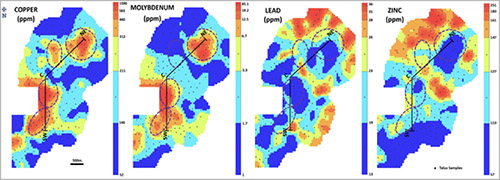

Figure 2: Talus copper, molybdenum, zinc, and lead geochemistry at Lacsha, showing patterns typically seen in certain porphyry deposits; anomalous copper and molybdenum high and lead-zinc low. Four targets are highlighted as circular dashed lines. Interpretation of Exploration Results

Surface lithology, structure and geochemistry together with new geophysical data at Lacsha are consistent with porphyry-related sulphide mineralization and strengthen a series of compelling drill targets (Figure 1):

- The ground magnetic survey identified several zones with highly magnetic response, which are interpreted to be associated with magnetite mineralization within a central porphyry potassic alteration.

- The recently completed IP survey defined extensive areas of high chargeability (>20 mv/v), which is a signature often associated with sulphide mineralization. The cores of these anomalies reach 25 mv/v at depths of approximately 100m from surface and potentially reflect copper sulphide mineralization.

- Areas of high resistivity (>2,000 ohm*m) are consistent with silicification (overlying a vertically zoned porphyry system.

Integration of surface geochemistry with geophysics is a critical step in exploration (Figure 2):

- Copper (>300ppm, up to 1590ppm) and molybdenum (>10ppm, up to 85ppm) anomalies (talus samples) are centered over the interpreted porphyry system where a copper rich core may be present.

- Zinc and lead depleted above the target (proximally), with anomalous values distally which is considered a typical geochemical zonation for upright, intact porphyry copper systems.

- The geochemistry dovetails with the surface geophysics where copper and molybdenum geochemical anomalies are coincident with magnetic (high) and IP chargeability (high) features increasing confidence in the drill targets.

Lacsha Presentation on Web Site

A presentation has been uploaded on the Company's website, which summarizes all aspects of the exploration completed at Lacsha to date.

Induced Polarization Survey Details

The IP survey was completed in Q1 2022, consisting of 18 lines oriented northwest-southeast. Lines are between 1.4km and 1.7km in length and spaced 200m apart for a total survey length of 27km. The survey was completed using a Pole-Dipole arrangement (multi-electrodes), with dipoles every 100m recording readings from the first to the tenth stations. Penetration depth is expected to be up to 600m from surface.

Next Steps

Having already executed community agreements through to the end of 2024, Latin Metals is applying for drill permits to test the highest priority target areas and permits are expected to be in place by Q4 2022. The Company is considering whether to complete initial drilling or to secure a partner to fund initial drilling, and a final decision is expected to be made on receipt of drill permits.

Coastal Copper Belt

The Coastal Copper Belt in Peru is a Cretaceous belt hosting a variety of deposit types including Porphyry, Epithermal, VMS and IOCG. Latin Metals' 100%-owned Lacsha Copper-Molybdenum, Lacsha Copper-Molybdenum, Auquis Copper-molybdenum, Yanba Copper-Molybdenum, Tillo, Para and Loli prospects are all located in the northern Lima-Ica portion of the coastal belt.

Latin Metals at PDAC 2022

Latin Metals will be exhibiting at PDAC 2022, and the Company invites conference attendees to visit the LMS booth #3124 at the Investor Exchange in the South Building of the Metro Toronto Convention Center from June 13 to 15, 2022. Company representatives will be on hand to discuss the prospect generator model as well as our work plans for the rest of the year.

QA/QC

The work program at Lacsha was designed and supervised by Eduardo Leon, the Company's Exploration Manager, he coordinates with Zissou Peru SAC principal geophysicist, Mr. Percy Sandoval who was the professional in charge of field collection data, sections, plan views, and reporting. Inversion modeling was completed by Geophysicist MSc Ronald Yupa.

Qualified Person

The technical content of this release has been approved for disclosure by Keith J. Henderson P.Geo, a Qualified Person as defined by NI 43-101 and the Company's CEO. Mr. Henderson is not independent of the Company, as he is an employee of the Company and holds securities of the Company.

About Latin Metals

Latin Metals is a mineral exploration company acquiring a diversified portfolio of assets in South America. The Company operates with a Prospect Generator model focusing on the acquisition of prospective exploration properties at minimum cost, completing initial evaluation through cost-effective exploration to establish drill targets, and ultimately securing joint venture partners to fund drilling and advanced exploration. Shareholders gain exposure to the upside of a significant discovery without the dilution associated with funding the highest-risk drill-based exploration.

On Behalf of the Board of Directors of

LATIN METALS INC.

"Keith Henderson"

President & CEO

For further details on the Company readers are referred to the Company's web site (www.latin-metals.com) and its Canadian regulatory filings on SEDAR at www.sedar.com.

For further information, please contact:

Keith Henderson

Suite 890

999 West Hastings Street

Vancouver, BC, V6C 2W2

Phone: 604-638-3456

E-mail: info@latin-metals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the negotiation of the Option Agreements and exercise of the Option for the Properties, the anticipated content, commencement, timing and cost of exploration programs in respect of the Properties and otherwise, anticipated exploration program results from exploration activities, and the Company's expectation that it will be able to enter into agreements to acquire interests in additional mineral properties, the discovery and delineation of mineral deposits/resources/reserves on the Properties, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, market fundamentals will result in sustained precious metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of the Company's Argentine projects in a timely manner, the availability of financing on suitable terms for the development, construction and continued operation of the Company projects, and the Company's ability to comply with environmental, health and safety laws.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include, among others, operating and technical difficulties in connection with mineral exploration and development and mine development activities at the Properties, including the geological mapping, prospecting and sampling programs being proposed for the Properties (the "Programs"), actual results of exploration activities, including the Programs, estimation or realization of mineral reserves and mineral resources, the timing and amount of estimated future production, costs of production, capital expenditures, the costs and timing of the development of new deposits, the availability of a sufficient supply of water and other materials, requirements for additional capital, future prices of precious metals and copper, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, possible variations in ore grade or recovery rates, possible failures of plants, equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, delays or the inability of the Company to obtain any necessary permits, consents or authorizations required, including TSX-V acceptance for filing of the Option Agreements, any current or future property acquisitions, financing or other planned activities, changes in laws, regulations and policies affecting mining operations, hedging practices, currency fluctuations, title disputes or claims limitations on insurance coverage and the timing and possible outcome of pending litigation, environmental issues and liabilities, risks related to joint venture operations, and risks related to the integration of acquisitions, as well as those factors discussed under the heading "Risk Factors" in the Company's latest Management Discussion and Analysis and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company's profile on the SEDAR website at www.sedar.com.

Readers are cautioned not to place undue reliance on forward looking statements. Except as otherwise required by law, the Company undertakes no obligation to update any of the forward-looking information in this news release or incorporated by reference herein.

Tidak ada komentar:

Posting Komentar