Vancouver, B.C. – Latin Metals Inc. ("Latin Metals" or the "Company") - (TSXV: LMS) OTCQB: LMSQF) is pleased to announce results of a recently completed rock sampling program at its 100% own Auquis project (the "Property") located in the Coastal Copper Belt, Peru. A total of 234 rock chip samples were collected to follow up on anomalous soil samples collected earlier in the year (see NR22-06, April 2022). Rock chip sampling has highlighted copper grades ranging from 22 ppm to 12.8% copper across the Property (Figures 1 and 2).

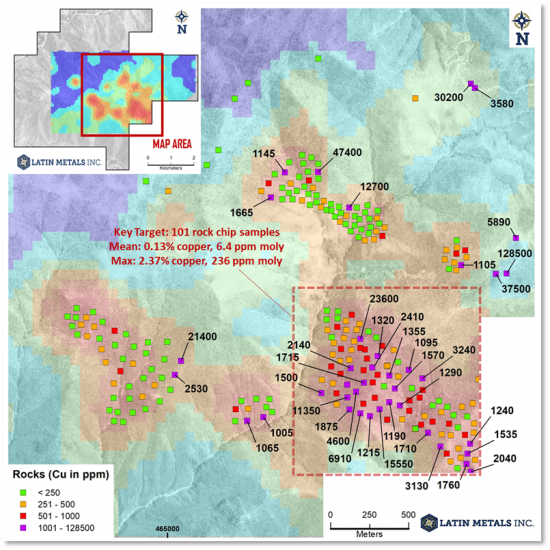

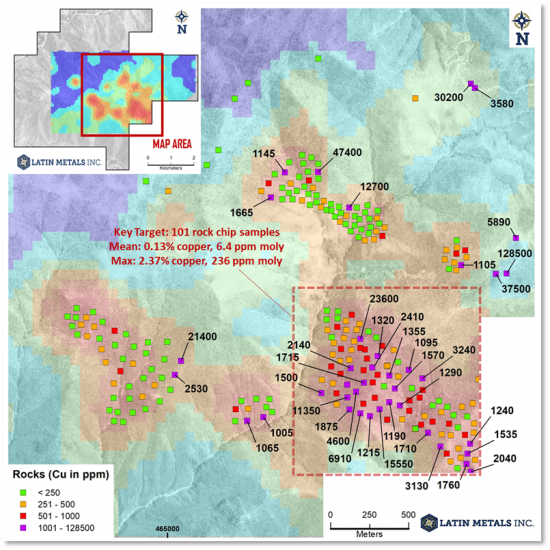

Figure 1. Map highlighting areas where recent rock chip sampling was completed over several peak soil anomalies at Auquis Property, Coastal Copper Belt, Peru. Area defined by red square shows very consistent copper mineralization over 1km x 1km extent.

Keith Henderson, CEO, commented, "Our recent follow-up sampling program has outlined a large 1km x 1km area of consistent mineralization where 101 samples returned copper values of up to 2.37% copper and 236 ppm molybdenum, with a mean value of 0.13% copper and 6.4 ppm molybdenum. We are very excited about these initial results, with many areas of this large 4,000 hectare property still unsampled."

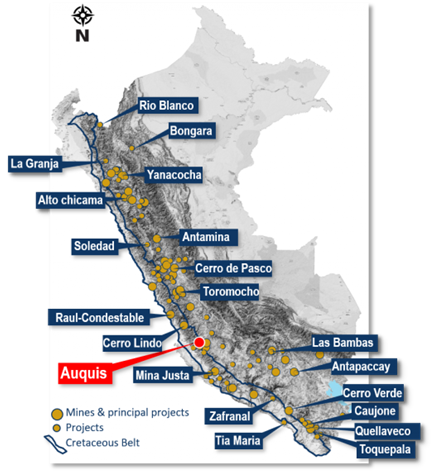

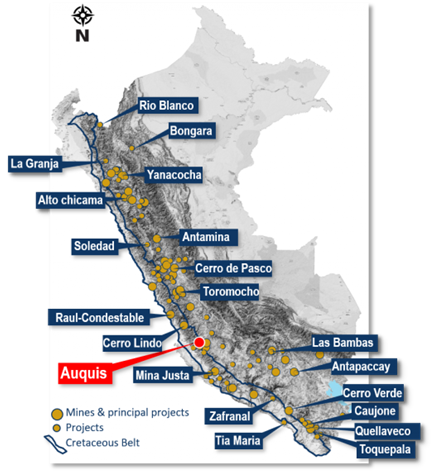

This portion of the Coastal Copper Belt is the focus of attention for several major mining companies, such as Newmont and Vale.

Figure 2. Location of the Auquis Property in Peru and within the Coastal Copper belt.

Rock Chip Sampling Details

Recently completed rock chip sampling was focused in the highly anomalous areas identified in a previous soil sampling survey. A total of 234 rock chip samples were collected with values up to 4.74% copper and 236 ppm molybdenum. Mean values from the 234 samples are 0.10% copper and 5ppm molybdenum. These results are very encouraging as regional results but looking more closely at the southeastern portion of the Property, mineralization is seen to be very consistent with highly anomalous values of copper and molybdenum. In this large 1km x 1km area, 101 samples returned values with a mean of 0.13% copper and 6.4 ppm molybdenum. This area is characterized by multiple phases of intrusive rocks with porphyritic textures and copper oxide mineralization.

Next Steps

Recent sampling was focused on testing existing soil anomalies. Other areas of the Property are still open for exploration, and the Company will extend the sampling program. Next steps include a property-wide rock chip sampling and geological mapping program in the next months to define the area for an initial ground magnetic survey.

QA/QC

The work program at Auquis was designed and supervised by Eduardo Leon, the Company's Exploration Manager, who is responsible for all aspects of the work, including the quality control/quality assurance program. On-site personnel at the project rigorously prepare and track samples which are security sealed and shipped to the ALS laboratory in Lima. Samples used for the results described herein are prepared and analyzed by multi-element analysis using an inductively coupled mass spectrometer in compliance with industry standards.

Qualified Person

The technical content of this release has been approved for disclosure by Keith J. Henderson P.Geo, a Qualified Person as defined by NI 43-101 and the Company's CEO. Mr. Henderson is not independent of the Company, as he is an employee of the Company and holds securities of the Company.

Investor Relations and Marketing

The Company has engaged BTV- Business Television ("BTV") to improve exposure to Canadian capital markets. The engagement is for an initial period of three months, renewable for an additional three months. As consideration, the Company will pay a total fee of $31,850. BTV produces a half-hour weekly investment show, profiles emerging companies across Canada and the US to bring investors information for their portfolio. On air for 20+years, BTV is broadcast nationally on BNN Bloomberg, FOX Business News, BizTV. With Hosts, Taylor Thoen and Jessica Katrichak, BTV interviews top analysts plus features companies at their location for an insightful business perspective. Services provided under the contract with Latin Metals include digital marketing on well-known financial web platforms BNN Bloomberg, Forbes, Yahoo Finance, Seeking Alpha, Financial Post, and Market Watch), Facebook advert campaign, mobile optimized banners, and TV advert for broadcast on BNN Bloomberg. To the Company's knowledge, BTV does not have any direct interest in the Company or its securities.

The Company has also engaged OTCWagon for a one-month market awareness program. As consideration, the Company will pay a total fee of $5,000. To the Company's knowledge, OTCWagon does not have any direct interest in the Company or its securities.

About Latin Metals

Latin Metals is a mineral exploration company acquiring a diversified portfolio of assets in South America. The Company operates with a Prospect Generator model focusing on the acquisition of prospective exploration properties at minimum cost, completing initial evaluation through cost-effective exploration to establish drill targets, and ultimately securing joint venture partners to fund drilling and advanced exploration. Shareholders gain exposure to the upside of a significant discovery without the dilution associated with funding the highest-risk drill-based exploration.

On Behalf of the Board of Directors of

LATIN METALS INC.

"Keith Henderson"

President & CEO

For further details on the Company readers are referred to the Company's web site (www.latin-metals.com) and its Canadian regulatory filings on SEDAR at www.sedar.com.

For further information, please contact:

Keith Henderson

Suite 890

999 West Hastings Street

Vancouver, BC, V6C 2W2

Phone: 604-638-3456

E-mail: info@latin-metals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the negotiation of the Option Agreements and exercise of the Option for the Properties, the anticipated content, commencement, timing and cost of exploration programs in respect of the Properties and otherwise, anticipated exploration program results from exploration activities, and the Company's expectation that it will be able to enter into agreements to acquire interests in additional mineral properties, the discovery and delineation of mineral deposits/resources/reserves on the Properties, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, market fundamentals will result in sustained precious metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of the Company's Argentine projects in a timely manner, the availability of financing on suitable terms for the development, construction and continued operation of the Company projects, and the Company's ability to comply with environmental, health and safety laws.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include, among others, operating and technical difficulties in connection with mineral exploration and development and mine development activities at the Properties, including the geological mapping, prospecting and sampling programs being proposed for the Properties (the "Programs"), actual results of exploration activities, including the Programs, estimation or realization of mineral reserves and mineral resources, the timing and amount of estimated future production, costs of production, capital expenditures, the costs and timing of the development of new deposits, the availability of a sufficient supply of water and other materials, requirements for additional capital, future prices of precious metals and copper, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, possible variations in ore grade or recovery rates, possible failures of plants, equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, delays or the inability of the Company to obtain any necessary permits, consents or authorizations required, including TSX-V acceptance for filing of the Option Agreements, any current or future property acquisitions, financing or other planned activities, changes in laws, regulations and policies affecting mining operations, hedging practices, currency fluctuations, title disputes or claims limitations on insurance coverage and the timing and possible outcome of pending litigation, environmental issues and liabilities, risks related to joint venture operations, and risks related to the integration of acquisitions, as well as those factors discussed under the heading "Risk Factors" in the Company's latest Management Discussion and Analysis and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company's profile on the SEDAR website at www.sedar.com.

Readers are cautioned not to place undue reliance on forward looking statements. Except as otherwise required by law, the Company undertakes no obligation to update any of the forward-looking information in this news release or incorporated by reference herein.

.png)