| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Kami PT Equityworld Futures yang berkantor pusat di Sahid Sudirman Center Lt. 9 Unit C,D,G,H, Jl. Jend. Sudirman No.86, Jakarta Pusat merupakan salah satu anggota Bursa Berjangka Jakarta (JFX) yang resmi berdiri pada tahun 2005.

Kamis, 05 Mei 2022

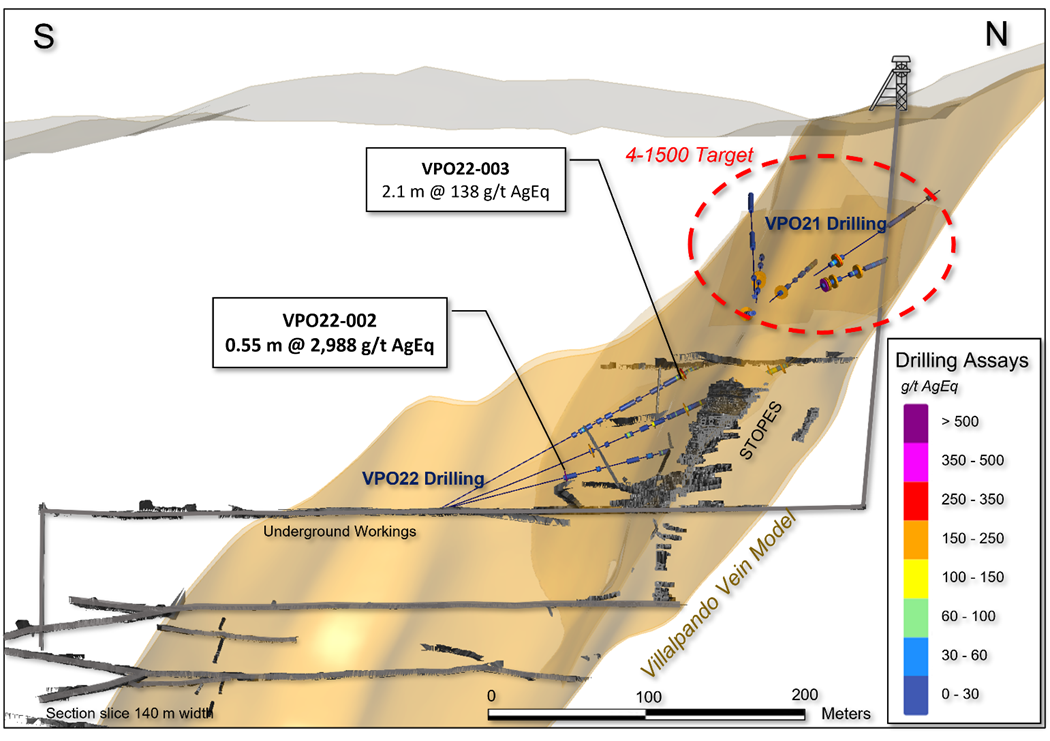

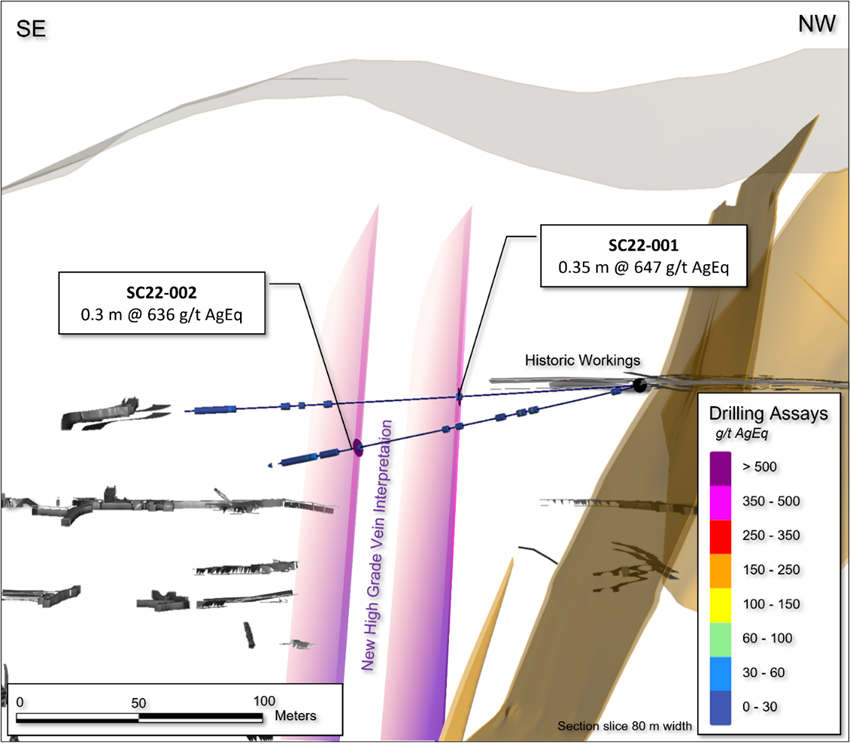

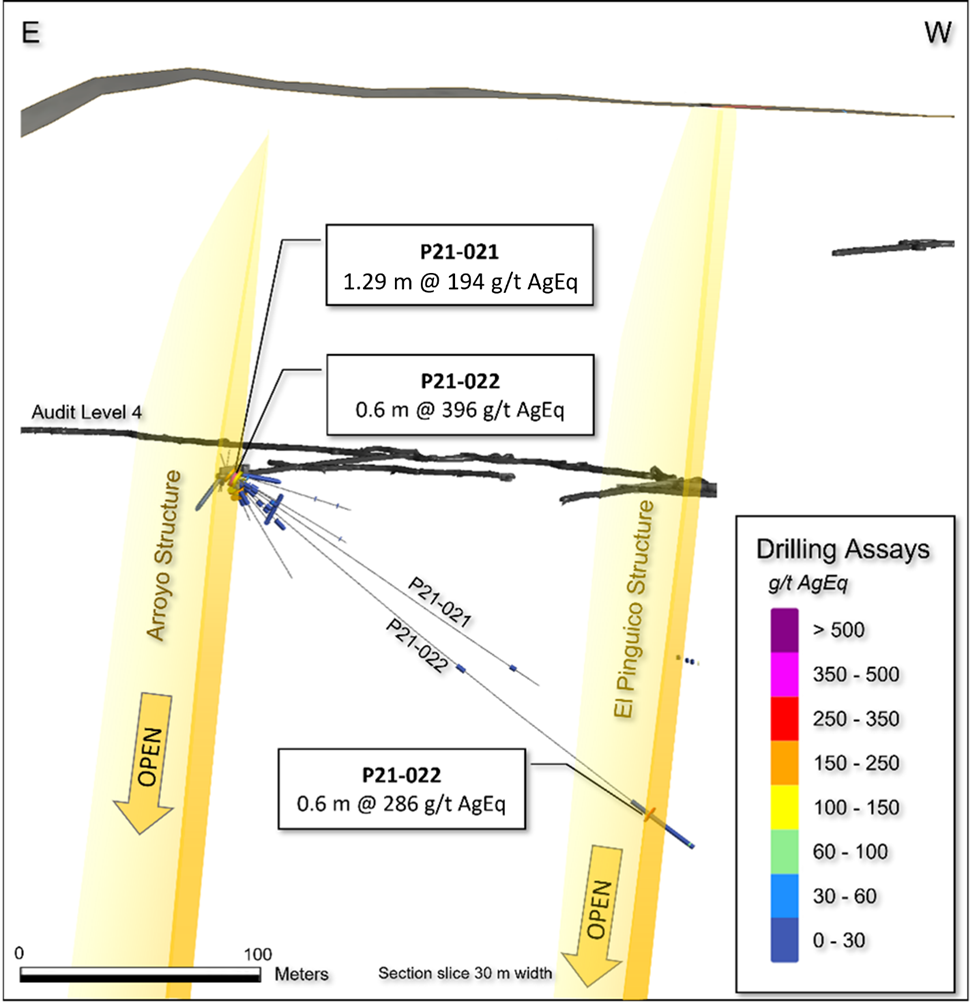

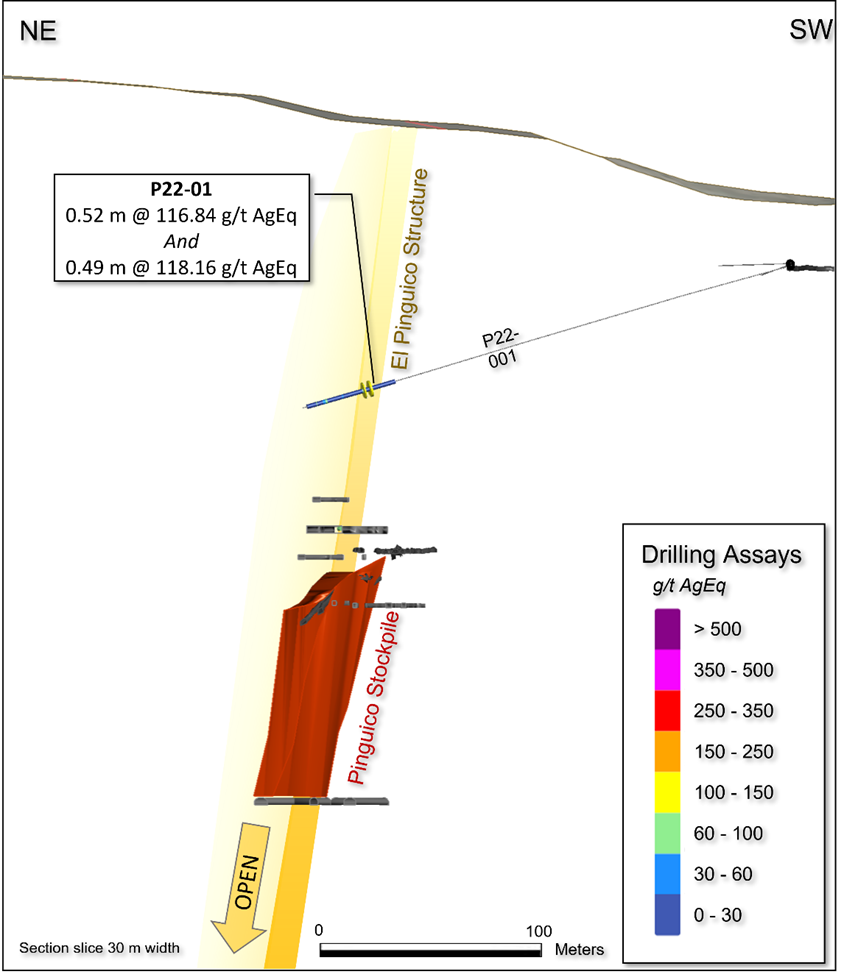

GSilver Drills 2,988 GPT AgEq Over 0.35m Estimated True Width at El Cubo

Rabu, 04 Mei 2022

African Gold Group Seeks Dual ASX Listing And Announces Board Changes

|